An Overview of the global mining economic situation

Currently, the global economy, which is significantly below expectation, has maintained a moderate slow growth, and still remains in a slow recovery and deep transitional adjustment period, with major countries show obvious differentiation characteristics. The current situation of global mining is still in the downward trend, which gives rise to the continued-falling of mineral products price, growing excess capacity and the weak main minerals demand. As we can expect, the so-called winter period of mining industry has not passed, and a full recovery will take time.

Under the “new normal”, the economy of China has shifted from the previous high speed to a medium-to-high speed growth, and the resource demand structure is constantly upgrading, which is making a big change of supply modes and spatial structure of resource utilization.

See changes through figures

Global mining index continues to go downward

Influenced by the weak and unstable recovery of global macro-economy, global mining index has kept the downward trend since the middle of 2011, but the speed slowing down significantly.

According to the Pipeline Activity Index (PAI) analysis of SNL, the PAI index from 74 points, the relative high level in the past two years from September last, fell to 50 points in February of this year. Then, it rebounded to 58 points in March before it declined again. Up to May, the PAI index fell to 41 point, which is the lowest of nearly 3 years; Meanwhile, the SNL metal price index has almost downed to the lowest point in nearly three years. Mining market capitalization has rebounded in this half year, but it was far less than the same period last year. Thus the situation of global mining industry will still be unsatisfactory in recent years, which seems to be no plan to make improvements.

Low Price of Major Commodity

International oil prices rebounded slightly in early 2015 after a price plunge in 2014. Overall, it is reasonable that the crude oil market was stabilizing after a shock upgoing in the first half year.

The international ironstone price once peaked close to $200/ t in recent years, then it began falling since 2014. The analysts of Goldman Sachs said that the ironstone price in 2015 was expected to drop to $52 /t, which was 18% lower than the previous expect.

The price of six kinds of base metal (LME copper, aluminum, lead, zinc, tin, nickel) showed obviously different trends. The price of copper, nickel and tin has kept a downward trend since 2011, while the price of aluminum, lead and zinc has been almost stable with a smaller fluctuation.

Less merger and acquisition cases of mineral company

According to the report issued by McKinsey, the mergers and acquisitions of global oil and gas declined dramatically in the first quarter of 2015. From the perspective of mergers and acquisitions of global mining, SNL statistics showed that a total of 24 cases of mergers and acquisitions happened in the first quarter of 2015,which was less than 43 cases in the fourth quarter and 52 cases in the third quarter of 2014. However, the total amount of it amounted to $4.67 billion, which was almost flat to that in the fourth quarter of 2014. As same as previous years, mining mergers and acquisitions were still largely focused on a few minerals such as gold and copper in the first half of this year.

On the background of the downward trend and depressed merge and acquisition activities of China Mining,China mining companies speeded up the pace of "going out", to cite Zijin Mining Group Co., Ltd as an example.

The increased financing difficulty of global mining

According to the data in May, the total mining financing reached to $10.03 billion in the first quarter of 2015, which declined dramatically compared with $15.47 billion in the fourth quarter and $22.08 billion in the third quarter of 2014.

According to the data of SNL, there were 592 financing activities in the first quarter of 2015, which also shows a large drop compared to 918 in the third quarter and 903 in the fourth quarter of 2014. As usual, the large listed companies (market value greater than 100 million dollars) accounted for the vast majority (95%) of the total amount of financing. Global mining financing projects mainly concentrated in the iron and steel company.

See trends through events

America`s shale oil industry rescued from the desperate situation

There were two reasons why the price of international oil declined since 2014. One was the reduced demand, and the other was the excess supply. However, lower oil price brought challenges to the shale oil revolution, and also had a negative effect on the business activities of shale oil manufacturers in the United States.

Although the investment and the number of drilling RIGS of the shale oil in North America were declining, productions of shale oil has not really been cut. Driven by continuous improvement in technology, the efficiency of mining enhanced gradually, and the oil production costs fell by about 20%.

Overall, shale oil revolution is still on the way instead of going bankrupt due to the lower oil price. The center of the production of global oil and gas has showed a "moving westward" trend, which will undoubtedly have a profound effect on the supply pattern of global oil and gas.

China-Australia Free Trade Agreement (ChAFTA) contributes to the cut of resource utilization cost

The China-Australia Free Trade Agreement (ChAFTA), signed on 17 June 2015, is the highest level of overall trade and investment liberalization in China. Upon full implementation of the agreement, tariffs of Australian exports will be lifted in four years, which will have a huge effect on the price of mining production, such as copper ore, nickel ore, alumina, zinc ore and coal.

Furthermore, China allowed the technical consultation and on-site service on coalbed methane (CBM) and shale gas provided by Australian servicer, as well as the consulting services on the mineral resource including oil, natural gas, iron, copper and manganese, which will make differences to the geological exploration departments and equipment manufacturing company in China, and also will bring revolution to the geological exploration units.

Overall, ChAFTA has not only lowered the costs of mining resources in China, but also stabilized the supply of it.

Zambia resources tax was first increased and then decreased to avoid outages

Zambia`s finance minister announced in October 2014 that, a new resource tax would be launched for copper production since 2015. Because of this, the royalty tax rate for open-pit mining went up to 20 percent from 6 percent, and the underground increased from 6% to 8%.

Tax increases, with the weak price and demand of the international copper mining, hit Zambian mining badly, which caused tension between mining companies and Zambian government. On April 14, Zambia`s cabinet set the royalty tax rate for open-pit and underground mining at 9 percent to avoid unemployment and off-stream in mining industry.

Countries such as Turkey and Gabon modified mining tax to promote the mineral exploration and development

Turkey, an important country along the “one belt one road”, modified its mining tax in February. Previously, if the licenses of the mining companies did not meet the requirements within the given time, it would be cancelled. However, the new tax broke the deadlock of the country`s mining right permission, which was even more friendly in terms of mining laws and policies for investors.

Gabon also passed the long-awaited modified mining tax at the beginning of the year. The new tax, which was carried out recently, showed a lot of changes in mining law system, becoming an important part of a new generation of African mining legal system construction.

Predict the future through trends

Global mining industry will meet a new development period

Global mining industry has been downward for four years, and the price of some minerals, such as gold, silver, aluminum, lead and zinc, has already been close to or reached their average cost of production. If the price continues to fall sharply, the whole industry will be at risk; other minerals, such as copper, nickel, tin prices continue going down, amplitude is still large, but the rate of decline has slowed down significantly, with the favorable factors such as destocking, it is expected to gradually stabilize in the short term.

The current development situation of mining companies is still hard. However, in the long term, with the development of Internet economy, significant adjustment of the global manufacturing pattern, and the new construction wave of infrastructure, the global economy will meet a new development opportunities eventually. Therefore,it is probably not far for global mining to get out of trouble.

From the perspective of the whole development situation of global economy, major economies are launching its own economic development plan, including the promotion of "Belt and Road" of China, the Asian Infrastructure Investment Bank and the Silk Road Fund. By 2015, almost 300 billion to 400 billion Yuan will be invested into "Belt and Road" in China, which is expected to boost GDP growth from 0.2 percent to 0.3 percent.

Thus it can be seen that, with a boom of new round global investment in infrastructure and the rapid development in emerging economies such as India and Indonesia, global mining could come across a new development opportunity, but it is unlikely to reach or exceed the previous peak.

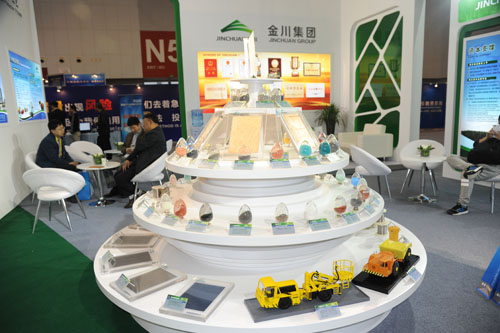

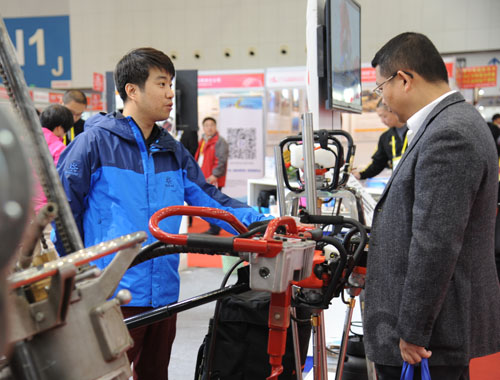

About CHINA MINING

Since first held in 1999, the scope and influence of CHINA MINING has grown rapidly year by year. As a global mining summit forum and exhibition, CHINA MINING Congress and Expo has become one of the world’s top mining events, and one of the world’s largest mining exploration, development and trading platforms, covering all aspects of the whole mining industry chain, including geological survey, exploration and development, mining rights trading, mining investment and financing, smelting and processing, mining techniques and equipment, mining services, etc. playing an active promotion role in creating exchange opportunities and enhancing mutual cooperation between domestic and foreign mining enterprises.

CHINA MINING Congress and Expo 2015 will be held at Meijiang Convention and Exhibition Center in Tianjin on November 20th-23rd, 2015. We invite you to join the event and to celebrate the 17th anniversary of CHINA MINING with us. For more information about CHINA MINING 2015, please visit: m.balanzskin.com.