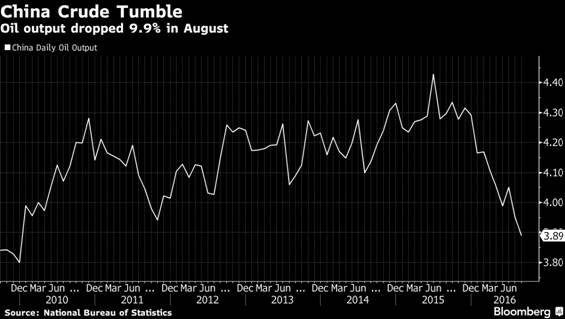

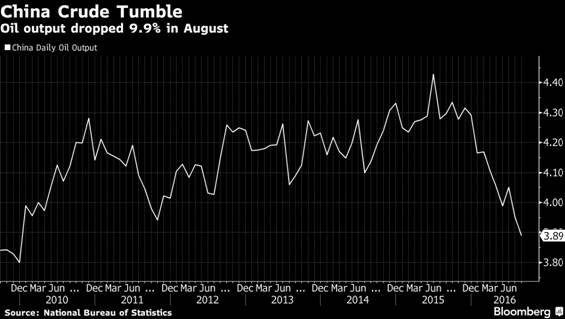

China Crude Oil Output Drops to 6-Year Low as Giants Shut Fields

Source: www.chinamining.org Citation: Bloomberg Date: September 14, 2016

China`s crude oil output dropped to the lowest in more than six years as the country`s state-run energy giants continued to pump less from aging, high-cost fields.

Production during August in the world`s largest energy consumer dropped 9.9 percent from a year ago to 16.45 million tons, according to data from the National Bureau of Statistics on Tuesday. That`s about 3.89 million barrels a day, the lowest since December 2009, according to Bloomberg calculations. Output is down 5.7 percent during the first eight months of the year.

"As crude prices fluctuate at a relatively lower level, there is no incentive for China`s high-cost producers to raise output any time soon," Tian Miao, an analyst with policy researcher North Square Blue Oak Ltd., said by phone before the data were released. Production will continue to decline through the rest of the year, Tian said.

Output from China, which was the world`s fifth-biggest producer last year, has been sliding as state-run companies shut fields too expensive to operate after prices fell earlier this year to the lowest since 2003. The country is forecast to lead production declines across Asia, helping tighten the global market as the world`s largest-consuming region relies more on overseas supplies.

Supply Destruction

"The global oil market rebalancing is progressing," said Gordon Kwan, head of Asia oil and gas research at Nomura Holdings Inc. in Hong Kong. "Massive capital expenditure cuts have translated to more oil supply destruction."

China`s crude oil imports increased to the highest in four months in August to about 7.77 million barrels a day, according to data by the General Administration of Customs released last week.

"Falling crude production supports rising imports through the rest of this year, coupled with strategic oil stockpiling and increased demand from refiners coming out of maintenance season," Amy Sun, analyst with Shanghai-based commodities researcher ICIS-China said by phone.

Production declines will accelerate in the final four months of the year, Sun said, with monthly crude production averaging 16.25 million tons, while oil imports average 32 million tons.

PetroChina, Sinopec

The country`s biggest producer, PetroChina Co. cut its 2016 domestic crude output target to 103 million tons (about 2.06 million barrels a day), a drop of about 6 percent from the previous year, as it shuts some high-cost fields. Production from China Chemical & Petroleum Corp., known as Sinopec, is on track to shrink by a similar amount to about 763,000 barrels a day, company forecasts show.

"China`s crude output won`t see an apparent rebound unless Brent recovers to $60 a barrel level, as most of China`s aging oilfields can`t make a profit below this price," Tian said. Brent crude, the global benchmark, has lost about half its value in the past two years. Prices have averaged almost $43 a barrel this year, compared with $99 in 2014.

While coal production in August rose 3 percent from the previous month to 278.09 million metric tons, production was down 11 percent from the same period last year, according to the statistics bureau. Coal mining in the first eight months slowed 10.2 percent to 2.18 billion tons.

Coal Deal

Major miners in the world`s largest consumer and producer of the fuel agreed last week to manage supply to stabilize prices in a deal with regulators that will see them increase output when the market is tight and cut production when there is oversupply. Qinhuangdao coal, one of the country`s benchmarks, has jumped more than 50 percent this year,

The impact of the new policy "could be seen almost immediately" as the country`s biggest miners including China Shenhua Group Corp. and China National Coal Group Corp. "can increase output almost overnight as some of their idled capacities have been in a ready-to-go status," North Square Blue Oak`s Tian said.

About CHINA MINING

Since first held in 1999, the scope and influence of CHINA MINING has grown rapidly year by year. As a global mining summit forum and exhibition, CHINA MINING Congress and Expo has become one of the world’s top mining events, and one of the world’s largest mining exploration, development and trading platforms, covering all aspects of the whole mining industry chain, including geological survey, exploration and development, mining rights trading, mining investment and financing, smelting and processing, mining techniques and equipment, mining services, etc. playing an active promotion role in creating exchange opportunities and enhancing mutual cooperation between domestic and foreign mining enterprises.

CHINA MINING Congress and Expo 2016 will be held at Meijiang Convention and Exhibition Center in Tianjin on September 22nd -25th, 2016. We invite you to join the event and to celebrate the 18th anniversary of CHINA MINING with us. For more information about CHINA MINING 2016, please visit: m.balanzskin.com.