Chinese miners ready to bulk up

Source: www.chinamining.org Citation: www.smh.com.au Date: Mar.05, 2013

A record wave of consolidation in China`s mining industry is creating bigger companies that will have the muscle to compete with the likes of BHP Billiton for overseas acquisitions.

Even after Chinese domestic mining mergers reached $US19.6 billion last year, double the tally for 2011, the government wants to see more. Easier access to capital and less Chinese competition for assets may make companies including China Minmetals and Aluminum Corp of China more robust overseas buyers, said Deloitte & Touche.

That`ll help reverse a slump in acquisitions of mining assets outside of China, which fell to a five-year low of $US2.9 billion in 2012, data compiled by Bloomberg show. As the world`s biggest importer of iron ore and coal, China relies on foreign sources of the raw materials.

``With stronger and bigger Chinese players emerging, we could see a significant pickup in the volume of overseas acquisitions,`` said Richard Tory, head of natural resources for the Asia-Pacific region at Morgan Stanley.

China`s mining industry, while one of the world`s largest producers of minerals including gold and tin, is now peppered with thousands of smaller companies. Minmetals, its largest miner by revenue, had assets of $US36.6 billion at the end of 2011 - dwarfed by BHP`s $US122.1 billion.

``China`s mining sector is too fragmented right now,`` said Eugene Qian, head of global banking for China at Citigroup. ``It needs a lot of consolidation to create majors.``

In January, the government said it would promote mergers in nine industries including steel, aluminum and rare earths to create ``globally competitive`` enterprises, according to a statement by the Ministry of Industry and Information Technology.

The announcement reinforced what`s already begun. Excluding deals between parent companies and their subsidiaries, the largest domestic acquisition last year was Hunan Jiangnan Red Arrow`s $US623 million takeover of Zhongnan Diamond.

``Creating national champions makes sense because mining is very capital-intensive, said Jeremy South, who oversees global mining advisory at Deloitte & Touche. ``It also makes no sense for Chinese companies to be competing with each other for overseas deals.``

Shenhua Group bought China State Grid Corp.`s electric-generation unit for $US8.2 billion last year. The Chinese state-owned miner is now studying an investment in Whitehaven Coal, two people with knowledge of the matter said.

Whitehaven, part owned by Nathan Tinkler, has a market value of $2.64 billion. The stock is trading at its lowest level since May 2009.

An official at Shenhua Group`s press department in Beijing declined to comment. Whitehaven Chairman Mark Vaile said February 21 that the company hasn`t had any recent dialogue with Shenhua

.

Citic Group, China`s largest state-owned investment company, last month agreed to pay about $452 million for a 13 per cent stake in Alumina, partner in the world`s biggest alumina business.

Other Chinese miners are also searching for deals. Chinalco Mining Corporation International may seek assets in South America, Africa and Asia, chief executive Peng Huaisheng said in Hong Kong on January 17.

Parent Aluminum Corp of China was the most active overseas acquirer among Chinese miners in the past decade with $US14 billion of deals, data compiled by Bloomberg show.

Minmetals could become one of the main Chinese buyers abroad, according to Deloitte`s South. Both Chinalco and Minmetals are state-controlled.

Zhaojin Mining Industry, China`s fourth-biggest gold producer, is studying takeovers in South America and other regions and may announce a deal ``in the near future,`` Chen He, assistant to the company`s president, said in November.

Two gold companies that could attract Chinese interest are Saracen Mineral Holdings of Perth and Colorado-based Alacer Gold, which has assets in Australia and Turkey, according to Troy Irvin, a Perth-based analyst at Argonaut Securities.

Their large reserves and production assets typically appeal to Chinese companies, Irvin said. Officials at Saracen and Alacer declined to comment or weren`t immediately available.

``The Chinese see the value of building bigger companies to compete with major mining companies in the world,`` said Deloitte`s South.

About CHINA MINING

Since first held in 1999, the scope and influence of CHINA MINING has grown rapidly year by year. As a global mining summit forum and exhibition, CHINA MINING Congress and Expo has become one of the world’s top mining events, and one of the world’s largest mining exploration, development and trading platforms, covering all aspects of the whole mining industry chain, including geological survey, exploration and development, mining rights trading, mining investment and financing, smelting and processing, mining techniques and equipment, mining services, etc. playing an active promotion role in creating exchange opportunities and enhancing mutual cooperation between domestic and foreign mining enterprises.

CHINA MINING Congress and Expo 2013 will be held at Meijiang Convention and Exhibition Center in Tianjin on November 2-5, 2013. We invite you to join the event and to celebrate the 15th anniversary of CHINA MINING with us. For more information about CHINA MINING 2013, please visit: m.balanzskin.com.

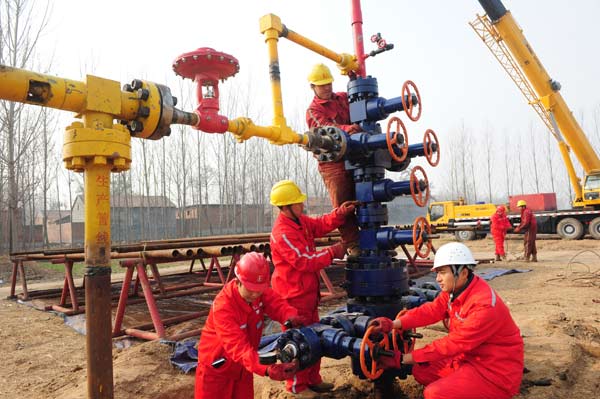

[Tong Jiang / China Daily]A natural gas production plant in Puyang, Henan province. According to the latest figures from the Ministry of Land and Resources, China has 134.42 trillion cubic meters of shale gas in its reserves.

[Tong Jiang / China Daily]A natural gas production plant in Puyang, Henan province. According to the latest figures from the Ministry of Land and Resources, China has 134.42 trillion cubic meters of shale gas in its reserves.